SPECIALIST CAR FINANCE LENDER

Easy Car Finance For Our Customers

Our Car Finance Options

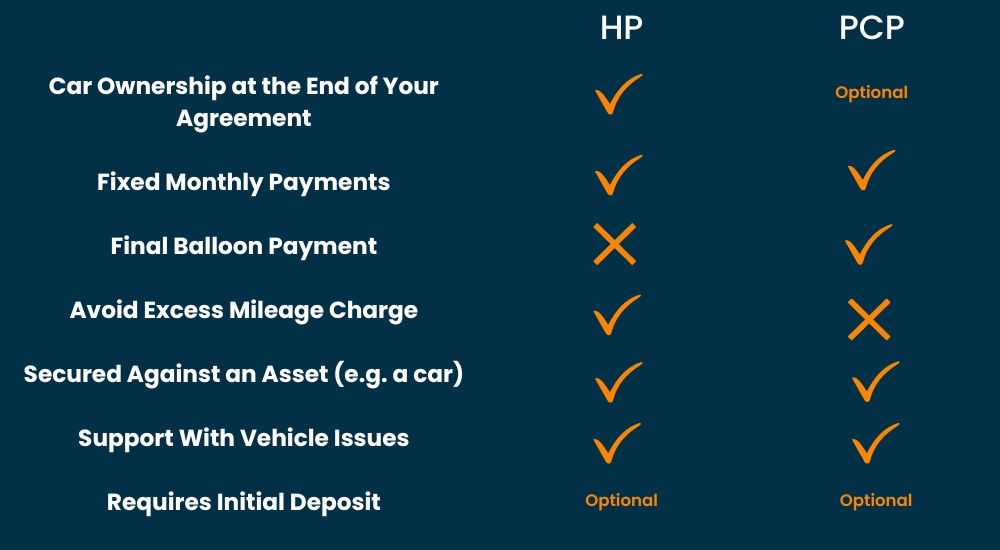

Marsh Finance offers both Hire Purchase and Personal Contract Purchase car finance – check out which car finance option is best for you.

Try Our Car Finance Calculator

👇

*By authorising a quote, this allows us to perform a soft credit search, which will not show up on your credit report. Only when you agree to proceed with an agreement will a hard search be conducted. The hard search will be recorded on your credit report.

Customer FAQs

How do I make an application?

You can apply straight from here on the website through our application form.

alternatively, If you would like to discuss making an application, email us at enquiries@marshfinance.co.uk or call us on 01706 648882, we look forward to hearing from you and helping you to organise sorting your next vehicle!

How long is the process?

Once we have all your details we have automated Underwriting which will review your eligibility within a couple of minutes. Once that is completed, the pay outs process takes around 2 hours to reach your dealer following a validation call with you.

How does my credit score affect my options?

As with many lenders, your score will affect how much your monthly repayments will be. If your score is lower, it might mean your payments are larger. There are many thing you can do if your score is low and you want to improve it—our top tips would be

1) make sure you’re on the electoral roll, it’s much easier to get credit if you’re registered.

2) Keep up to date with your bills, it’ll show lenders you can keep up to date with payments

3) Fix any mistakes on your report, by checking it regularly you can make sure its up to date with no mistakes.

If any doubt, contact a credit referencing company to discuss your specific

What forms of ID can I use?

You’ll need your driving license, a recent pay slip and in some cases 3 months of bank statements.

What would my finance journey with Marsh look like?

1) You submit a proposal to Marsh Finance and the deal is underwritten and reviewed.

2) If you’re eligible and have been approved for finance we will advise the Dealer or Broker (depending on how you’re purchasing your vehicle)

3) You will then go through the terms of conditions of the contract, and then be asked to E-sign the finance agreement. All we’ll need is your proofs such as driving license and your most recent pay slip.

4) We then wait for the Dealer or Broker will then submit the proofs, finance documents and invoice to Marsh Finance Limited, who will then validate all documents, and confirm the details over the phone with the customer, at which point if all the information is valid we will then pay the dealer / broker for the car.

5) Once this is done then you can collect the car.

Can I change my monthly costs?

You can partially settle by paying a lump sum which would lower your monthly repayments or shorten the term but you cannot renegotiate your agreement.

Can I settle my agreement early?

Yes, you can settle your agreement at any time either by paying off the existing balance or by part exchange from your dealer who will work with us to organize your settlement.

Do I need a deposit?

For agreements like PCP and HP, you will agree with us on a deposit and it will affect your month repayments (the bigger the deposit, the smaller the monthly repayments)