Refinance Your Car: Unlock New Possibilities

Your Path to Financial Flexibility

Car refinancing is your key to financial flexibility, giving you the choice of a new car, a cheaper agreement and financial ease. Refinancing allows you to choose finance that fits your needs, which has never been more important with the ongoing cost-of-living crisis.

Coming up to your balloon payment? Refinancing can also help you with this. Explore refinancing options and take control of your finances.

Refinance Today

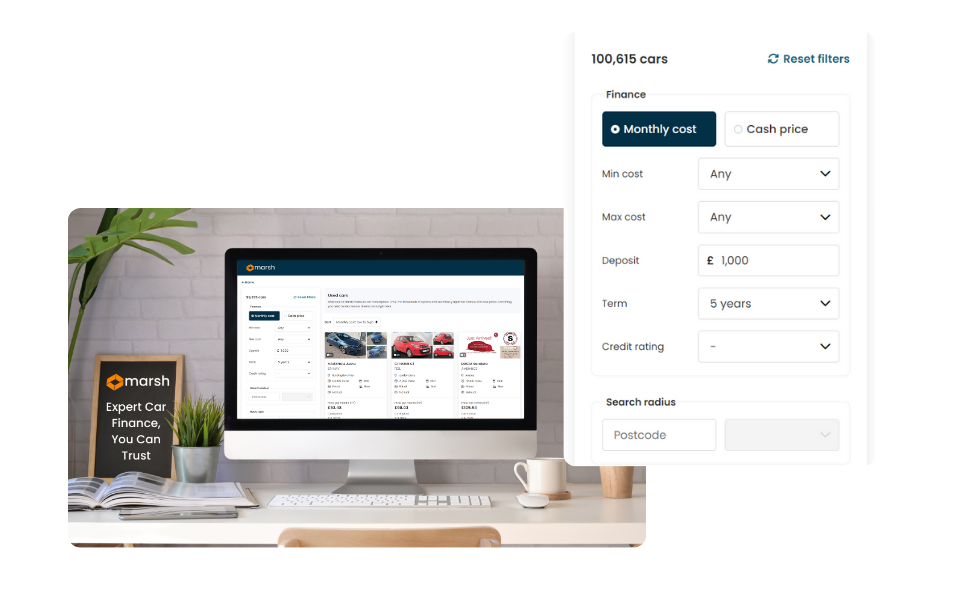

Whether you’re a new or existing customer, Marsh can be your home for refinancing. With nearly 50 years of experience in the car finance industry, we have tailored our approach to get the very best for our customers. Start your refinance journey with a leading car finance provider today.

Refinancing FAQs

What does it mean to refinance?

Refinancing is changing your current car finance deal for a new one. This can come in many forms, such as a car upgrade or downgrade, as well as lower monthly repayments across a longer agreement. Refinancing is a great option if you are struggling to keep up with your current finance agreement or are in a position to get a better car.

If you want to refinance with Marsh, you can expect customer service 50 years in the making, as well as flexible rates and options, giving you everything you need to drive off into the sunset in your dream car.

Will refinancing affect my credit score?

Your credit score will likely take a small hit early on, but will recover over time, providing you make all your payments on time.

Are there specific requirements to be eligible for refinancing?

The most important thing you can ensure is that you can afford the car finance agreement on offer. When you choose to refinance, you are committing to a fresh agreement, and although the terms may seem enticing you must ensure the terms are affordable in the long run.

How does refinance affect my balloon payment?

If you are struggling with an impending balloon payment, refinancing may be a good option. With refinancing, your loan provider will pay the balloon payment and you will repay them over a fixed period. If this works for you, complete our quick and easy refinance form and a member of our team will be in touch.

Can refinancing help me save money during the cost-of-living crisis?

Refinancing can be a good option if you are struggling to keep up with payments. By refinancing, you can change your agreement to cheaper monthly payments, either by downgrading your vehicle or extending your loan period to ensure you make full repayment. If you are ready to refinance, click here.

Can I refinance my car with another company?

Of course! Here at Marsh, we can be a great option to refinance with. 50 years in business, we are a great option for your financing needs. With flexible options and a dedicated support network, we will have your best interests at the forefront of our service.