No Deposit Car Finance

How Does No Deposit Car Finance Work and What Are The Benefits?

Looking to Buy a Car But Don’t Have the Cash for a Deposit?

If you’re looking to buy a car but don’t have the cash for a deposit, no-deposit car finance may be the solution for you. But what exactly is no deposit car finance, and what are the benefits and risks?

This page will cover everything you need to know about this popular financing option, including the different types of finance available, eligibility criteria, and how to apply.

We’ll also explore the pros and cons of no-deposit car finance and answer some frequently asked questions to help you make an informed decision. Read on to discover if no-deposit car finance is the right choice for you.

What is No Deposit Car Finance? Why is it a Popular Option?

No deposit car finance allows you to purchase a car without an upfront deposit. Instead, you pay off the cost of the vehicle over a fixed period, usually between 12 and 60 months.

It’s a popular option for people who don’t have the cash for a deposit or who would prefer to keep their savings for other purposes.

With no deposit car finance, you can spread the cost of the car and make manageable monthly payments. However, it’s essential to consider the interest rates and any fees involved in the finance agreement before committing to a no-deposit option.

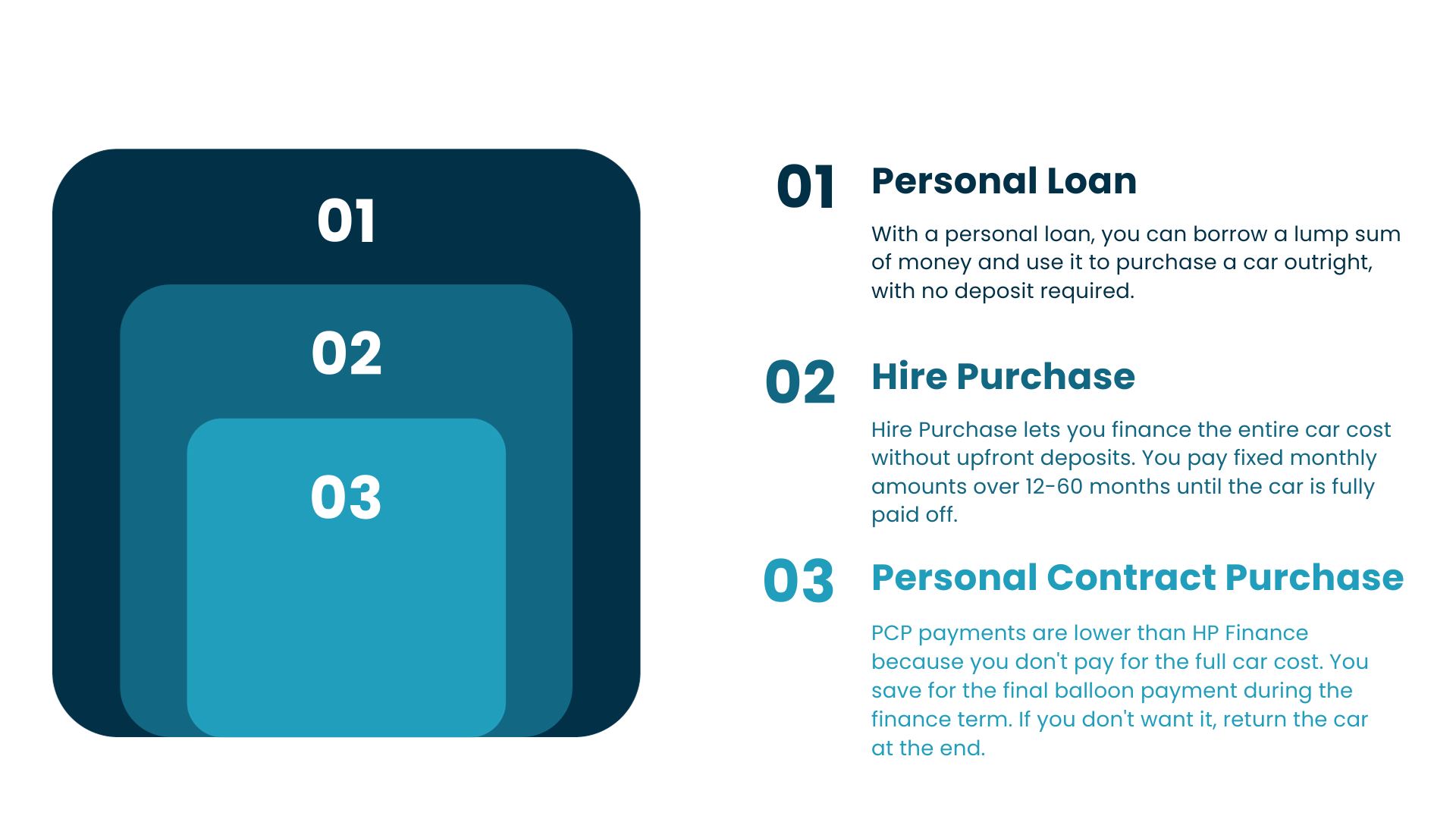

What Types of Car Finance Do You Not Need a Deposit For?

Arguments For and Against No Deposit Car Finance

Like any form of finance, there are positives and risks associated. Each form of car finance is totally dependent on the customer’s circumstances and desires. To gain a more detailed explanation of no deposit car finance, visit our in-depth article here.

Alternatively, view the main benefits and risks of no deposit car finance, and make a decision that suits your individual purchasing needs.

No deposit car finance is a solid car financing option in that it reduces up front cost and allows you to save towards an eventual large payment. This can be useful if you are cash-strapped or struggling during the cost-of-living crisis, where no deposit will remove the upfront financial burden and give you the time to build up income.

A drawback of no deposit car finance is the likely higher interest rates and longer repayment term, as lenders view no deposit car finance as a greater risk.

No Deposit Car Finance FAQs

What eligibility criteria do I need for no deposit car finance?

Eligibility criteria will remain the same as for alternative forms of car finance. The following factors affect a credibility check;

- Credit Score: Your credit score determines your car finance eligibility. Lenders will use this to assess your creditworthiness and determine the interest rate they offer you.

- Affordability: Lenders want to ensure you can afford the monthly repayments on the car finance agreement. This includes assessing your income and expenses to determine your affordability.

- Employment Status: Lenders usually require a stable job and income to ensure they can make the monthly repayments on the car finance agreement.

- Age: Generally, you must be at least 18 years old to apply for car finance. However, some lenders may have minimum age requirements.

- Documents Required: When applying for car finance, you’ll need to provide certain documents, such as proof of income, proof of address, and a valid driver’s license.

Can I get no deposit car finance with bad credit?

It is unlikely you will be able to get no deposit car finance with bad credit. This is because lenders will see no deposit as an increased risk, with the customer having to pay higher monthly instalments. Someone with a poor credit score may be seen as unable to make higher monthly payments. Lenders will likely recommend you put down a deposit instead.

How do I apply for no deposit car finance?

Applying for no-deposit car finance is the same process as any car finance agreement.

First, budget and ensure you can afford the car and finance you want.

Then, collect all the necessary documents and ensure your credit score is as strong as possible.

Applying is easy; fill out an application form and wait for a decision.

Here at Marsh Finance, we have a simple one-page application form that can see you receive a decision the same day.

Interested in applying? Click here to apply for car finance quickly and easily.

Do I need a good credit score to apply for car finance?

Not necessarily! While having a good credit score can certainly make it easier to get approved for car finance, there are lenders out there who are willing to work with borrowers who have a poor credit history. Even if your credit score isn’t great, you still have options available to you. With a little bit of effort, you could be driving away in your new car in no time!

It only takes 30 seconds to submit a car finance application with Marsh, you’ll receive a decision on the same day, without impacting your credit score.