Car Finance Calculator

Welcome to our car finance calculator.

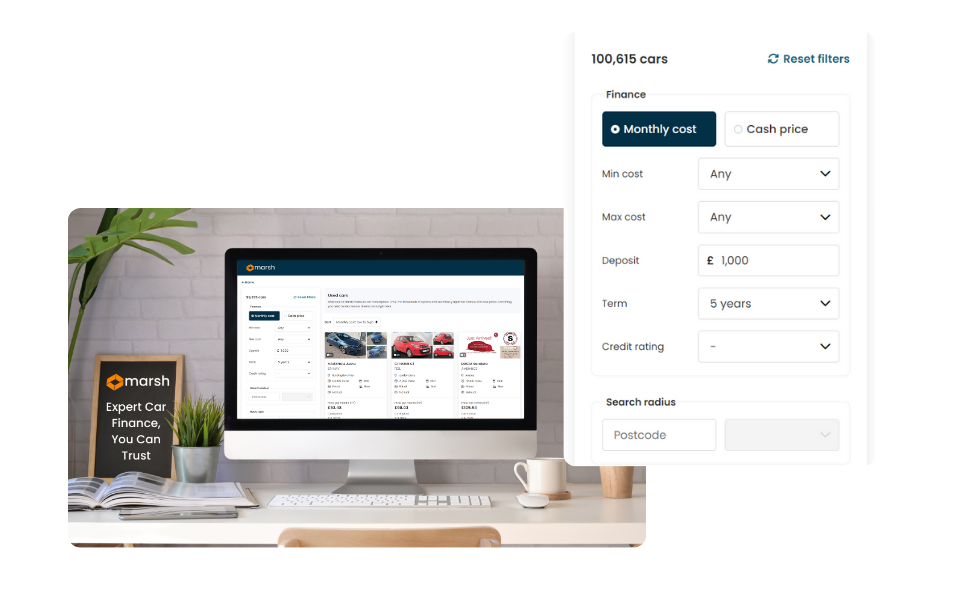

Thinking about purchasing a car through Car Finance? Use our car finance calculator to find out how much you can borrow. Input your loan amount, credit score, and loan term, and our calculator will provide you with results instantly.

Simplify

Navigating the world of car finance can be daunting but worry not – Marsh Finance is here to simplify the process for you. Introducing our quick and easy car finance calculator. With just a few simple inputs, our calculator estimates your monthly repayments based on your income and desired loan amount.

Tailored

Rest assured; the calculator is a helpful guide, not a commitment to purchase. It empowers you to create a budget that suits your needs before proceeding with a full car finance application.

Clear Picture

Our calculator gives you valuable insights into your potential monthly payments, giving you a clear picture of what to expect based on how much you’d like to borrow.

Try Our Car Finance Calculator

👇

The beauty of our calculator lies in its flexibility. Adjust any of these variables, such as loan amount or loan duration, and witness the immediate impact on the results.

But wait, there’s more! While our car loan payment calculator offers an approximate guide based on specific credit ratings, we understand everyone’s circumstances are unique. When you apply for car finance, factors like your personal credit rating and the criteria of the loan provider come into play. Your repayments may vary slightly from the calculator’s rough estimate.

Are you ready to unlock the full potential of our car finance calculator? Let it be your trusted companion in making well-informed decisions, empowering you to confidently navigate the exciting world of car financing.

Unlocking the Magic: How Does the Car Finance Calculator Work?

Curious about how our car finance calculator works its magic? Let us unveil its secrets! This powerful tool utilises various variables to calculate accurate results, including:

Amount Borrowed: Determine the loan amount you wish to borrow for your car purchase.

Credit Score: Select which credit score bracket you fall into.

Length of the Loan: Specify the duration, whether you prefer a longer or shorter term for repayment.

Monthly Payments: Discover the estimated monthly payments based on the provided variables.

Your Guide to Financing Your Car Purchase

Purchasing a car through car finance can seem complex – but it doesn’t need to be. Let us simplify it for you.

Hire Purchase (HP): Own Your Dream Car

With Hire Purchase, you can secure a loan for your car’s total value minus an initial deposit if applicable. Your monthly repayments are fixed over an agreed term until the loan is fully paid off. Once you’ve paid your final instalment, the car becomes yours.

Personal Contract Purchase (PCP): Flexibility

Instead of borrowing the total cost of the car, the loan covers the estimated depreciation, along with fees and interest for the contracted period. If you want to keep your vehicle at the end of this agreement, you’ll be expected to pay a lump sum for the remaining value of the car; this is called a balloon payment.

Personal Contract Hire (PCH): Convenient Long-Term Rental

PCH is considered a long-term rental which allows you to lease a car. You’ll be expected to make monthly payments for a contracted duration. At the end of this agreement, you return the vehicle and settle any applicable charges like excess mileage or wear and tear.

How to Choose the Best Car Finance Option for You

When choosing the ideal car finance option, we want you to find the one that perfectly fits your needs, preferences, and financial circumstances. Among the sea of options available, two stars stand out: Personal Contract Purchase (PCP) and Hire Purchase (HP). Let us show you why they are the crowd’s favourites!

Why Choose Marsh Finance

Experience You Can Trust:

With over 50 years of industry experience, Marsh Finance brings a wealth of knowledge and expertise to the table. We’ve been through it all, and our seasoned team is here to guide you every step of the way.

Direct Lender, Direct Connection:

Say goodbye to intermediaries and hello to a direct connection with Marsh Finance. As a direct lender, we eliminate the hassle, ensuring a smoother and more personalised experience. We’re here to listen, understand, and cater to your unique needs.

Your Credit Score Matters:

We get it – your credit score is important to you. That’s why our applications have zero impact on your credit score. Take a deep breath and apply confidently, knowing your financial reputation remains intact.

Swift Decisions, Same-Day Results:

Time is of the essence, and we value your precious time. At Marsh Finance, we’re committed to providing quick decisions. Apply today, and you’ll receive a decision on your car finance application the very same day. No more waiting in limbo – we keep the wheels turning.

Hassle-Free Experience:

We take the hassle out of car finance. Our dedicated team works diligently to ensure a smooth and stress-free process. From application to approval, we’re here to guide you, providing exceptional customer service every step of the way.

Car Finance Calculator FAQs

Can I adjust the loan amount and loan term in the car finance calculator?

Absolutely! Our car finance calculator is designed to be flexible. You can easily adjust the loan amount and loan term to explore different scenarios. Feel free to play around and find the perfect combination that suits your needs. It’s all about putting you in control of your car finance journey.

What information is needed for a car finance application?

Great question! When applying for car finance, you’ll typically need to provide some key information. This may include details such as your personal identification, employment and income information, proof of address, and the car you want to finance. Don’t worry; our friendly team will guide you through the application process and tell you exactly what information is required. We’re here to make it as easy as possible for you to get behind the wheel of your dream car!

Does using the car finance calculator affect my credit score?

Using our car finance calculator won’t impact your credit score. It’s just a handy tool to help you plan and make informed decisions.

What information do I need to input into the car finance calculator?

With just a few taps, enter your loan amount, credit score, and loan term, and witness the magic unfold. Our calculator works behind the scenes, crunching the numbers instantly to deliver your quote.

How does a car finance calculator work?

Our car finance calculator provides instant results. Simply input your loan amount, credit score, and loan term to find out how much you can borrow. If you’re satisfied with the quote, continue your application, receive a same-day decision, and hit the road in no time.

How can I improve my chances of getting approved for car finance?

Check out our article on how to improve your chances of getting approved. This article will provide you with hints and tips on how to improve your chances of being accepted for car finance.

How long does it take to receive a decision?

Once you apply with Marsh Finance, you’ll receive a decision on the same day!

Are the results provided by the car finance calculator accurate?

We strive to provide you with the most accurate estimate possible based on the information you provide. Our car finance calculator considers factors such as loan amount, credit score, and loan term to generate a quote tailored to your input. However, it’s important to note that the results are estimations and may be subject to slight changes when you proceed with your application. Credit scores and affordability assessments can influence the final terms offered. Rest assured; we aim to provide a realistic and reliable quote to help you make informed decisions about your car finance journey.

What is the difference between interest rate and Annual Percentage Rate (APR)?

The interest rate is the basic borrowing cost, while the Annual Percentage Rate (APR) includes additional fees and charges. Think of the interest rate as the core expense and the APR as the total cost of borrowing. We’re here to guide you through the financial jargon and help you make sense of it all. Feel free to reach out if you have any more questions – we’ve got you covered!