Personal Contract Purchase Car Finance

Want a new car without breaking the bank? Personal Contract Purchase (PCP) car finance lets you spread the cost over affordable monthly payments. There’s a final payment at the end, but you have the flexibility to own, return, or upgrade.

What Is PCP Car Finance?🤔

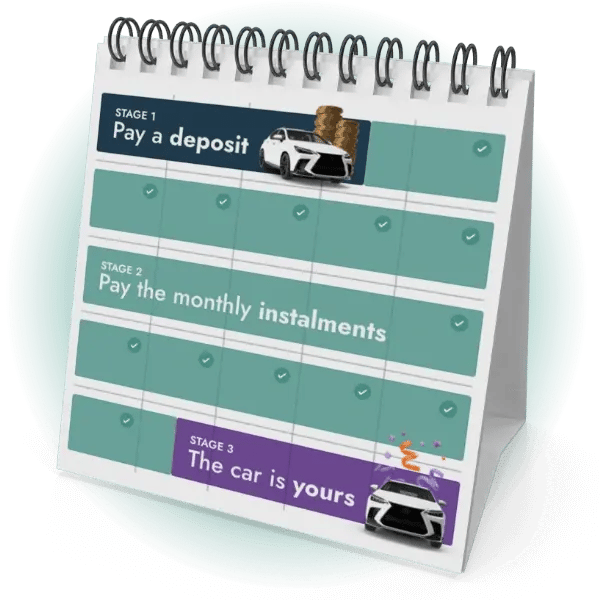

PCP car deals offer a flexible path to vehicle ownership. You'll start with a manageable deposit upfront, followed by fixed monthly payments spread comfortably over 2-4 years.

At the end of the term, you have three choices: return the car, pay a final balloon payment to own it, or trade it in.

PCP agreements have mileage limits and wear-and-tear guidelines. Interest rates will vary depending on your credit score. Interested in understanding your credit score more?

Cost-Effective

PCP payments are lower than HP (Hire Purchase) Finance because you don’t pay for the full car cost. You save for the balloon payment during the term. If you want to change vehicle, you can return the car at the end.

Transferrable

At the end of a PCP agreement, it is easy to roll over to a new car. If the value of the car is worth more than the balloon payment, you can use the difference as a deposit on another vehicle.

Protected

PCP protects against vehicle depreciation. At the start of the agreement, a Guaranteed Minimum Future Value (GMFV) is set. If the car starts to depreciate quicker than the GMFV, the car can be handed back.

The Role of Deposits in PCP Agreements⚖️

In PCP finance agreements, a deposit has the same effect it does in other car finance agreements. A higher deposit will reduce monthly car repayments.

A large deposit will not affect balloon payments. This is because the balloon payment is based on the GMFV set out at the start of the agreement. A balloon payment will not change during the agreement and cannot be affected by a deposit.

Looking to finance a car without a deposit? We offer that, too! Check out our no-deposit car finance page.

Pay Your Balloon Payment

Make a lump sum (also known as a balloon payment) payment to purchase your car outright.

Part Exchange

If you have positive equity on your car, you can use it as a deposit on a new vehicle.

Hand The Car Back

If your needs change and you no longer require a vehicle, you can simply return the car.

.png?width=600&height=500&name=Balloon%20Car%20(1).png)

A balloon payment is a large, lump sum payment due at the end of a car loan term. Also known as a ‘residual payment’, this payment is typically much larger than the monthly payments made during the loan term. Learn more about balloon payments.

When you take out a car loan with a balloon payment, you will make smaller monthly payments during the loan term, typically three to five years. These payments will only cover the interest on the loan and a portion of the principal amount. At the end of the loan term, you will need to make a large payment to cover the remaining principal amount of the loan, which is the balloon payment. When you enter into a balloon payment agreement, the end sum and prices will never change, so you can budget with the safety of repayments remaining the same.

Your Car, Your Way – Without The Hassle! 🚗

Fill in our quick search form, and we’ll take care of the rest. Whether it’s a sleek sports car or a reliable family SUV, we’ll hunt down the best choices for you. Easy, stress-free, and totally tailored to you!

.png?width=600&height=600&name=Personalised%20Car%20Search%20Graphic%20(1).png)

Personal Contract Purchase (PCP) FAQs

What is a balloon payment?

In a PCP (Personal Contract Purchase) car finance agreement, a balloon payment is a bigger lump sum you pay at the end. It's usually more than your regular monthly payments. This amount is based on what the car is estimated to be worth in the future (called Guaranteed Minimum Future Value or GMFV).

The good news? You have options:

- Pay the balloon payment: If you love the car and want to keep it, you can pay the remaining balance to own it outright.

- Hand the car back: No need for the balloon payment if you'd rather return the car and walk away.

Ready to explore PCP options? Let's find the right car finance deal for you!

What happens at the end of a PCP agreement?

PCP gives you flexibility! Here are your choices:

- Own the car: Pay the final balloon payment (like a big lump sum) to keep the car.

- Trade-in for a new car: If your car's worth more than the GMFV (guaranteed minimum future value), you can use that extra money (equity) as a down payment on a new PCP or HP car finance deal.

- Return the car: Simply hand the car back, as long as you've made all your payments and kept the car in good condition (check your agreement for details).

Can I pay off my PCP car finance agreement early?

You can, but it can be pricey. Personal Contract Purchase (PCP) relies on a final big payment (balloon payment) at the end. If you pay off early and want to keep your car, you'll still owe that balloon payment along with any remaining monthly payments all at once. It's a big chunk of money!

We can still help with PCP! Let's find the perfect car finance deal for you today.

This should not be taken as financial advice. You should speak to a financial advisor to determine whether ending your agreement early is right for you.

What is guaranteed minimum future value?

GMFV (Guaranteed Minimum Future Value) is an estimate of what your car will be worth at the end of your PCP deal. Think of it like a price tag experts guess your car will have in a few years.

Why does GMFV matter?

- PCP payments: It helps determine your monthly payments.

- Your choices at the end: It affects the balloon payment that is due at the end of your PCP agreement.

What affects GMFV?

- Car details: The make, model, and condition of your car.

- Miles driven: How many miles you put on the car.

- PCP agreement length: How long your PCP deal lasts.

.

How do I make an application?

Applying for PCP is easy! Here are your options:

- Apply online: Fill out our quick and secure application form right here on our website.

- Talk to us: Our friendly team is happy to answer your questions and guide you through the application process.

- Email us at direct@marshfinance.co.uk

- Call us on 01706 648882

We're here to help you find the perfect PCP deal for your new car!

How long does it take to get approved?

We strive to get you approved quickly! Here's a breakdown:

- Fast check: Our automated systems can give you an initial decision within minutes.

- Extra info needed? Sometimes we might need a little more information to finalise your agreement.

- Approved? We'll call! Once you're approved, we'll call you quickly to confirm details and perform a final credit check.

- Money on its way: After the call, it usually takes about 2 hours to send the funds to your dealer.

Our goal is same-day approval, but it can vary depending on extra info needed.

We want to get you behind the wheel of your new car as soon as possible!

How does my credit score affect my options?

Your credit score is one factor we consider when approving your PCP car finance application and determining your interest rate. Generally, a higher score can qualify you for lower monthly payments.

Here are some ways to improve your credit score:

- Make sure you're on the electoral roll.

- Pay your bills on time and in full.

- Fix any errors on your credit report.

For more personalised guidance, contact a credit referencing company.

What forms of ID can I use?

To verify your identity, you'll need to provide the following:

- Valid Driver's License: This is the primary form of ID we accept. A European license is also acceptable.

- Recent Pay Slip: This helps us confirm your income for the application.

While we can't accept bank statements as ID, we may request other documents during the application process to finalise your agreement.

We recommend having all your documents readily available for a smooth application process.

Getting a new car with Marsh Finance: step by step

Here's what you can expect when you apply for car finance with Marsh Finance for your dream car:

- Quick Application: Apply online in minutes, and we'll review your information.

- Fast Decision: You'll get a quick answer on your financing eligibility.

- E-Sign Your Agreement: If approved, you'll electronically sign the contract and provide us with some documents (driving license, payslip).

- Funds to Dealer: Once everything checks out, we'll send the money to your dealer within 2 hours (subject to a confirmation call).

- Pick Up Your Car!: Once the dealer receives the funds, you can drive away in your new car!

Can I change my monthly payments?

PCP agreements are set terms, so you can't renegotiate your monthly payments in the traditional sense. However, you do have some flexibility:

- Partial Settlement: You can make a lump sum payment towards the remaining balance of your PCP loan. This could:

- Lower your monthly payments (because you owe less overall)

- Shorten the loan term (you pay off the loan faster)

Thinking about a partial settlement? We can help you explore your options and understand the impact on your agreement.

Can I end my agreement early?

Yes, you can end your car finance agreement early, but it's important to understand the costs involved. There are two main ways to do this:

- Settlement: You can pay off the remaining balance of your loan in full. This can be expensive, so be sure to factor in any fees associated with early termination (check your agreement for details). To settle your existing agreement, visit your online account centre.

- Part-exchange: If you're buying a new car, you can trade in your current PCP car and use the equity (difference between the car's value and what you owe) towards the down payment on your new car.

Do I need a deposit?

A deposit isn't mandatory for PCP or HP car finance agreements. However, for both PCP and HP:

- A bigger deposit can lower your monthly payments. The more you put down upfront, the less you borrow, and the lower your monthly payments will be.

- We offer no deposit finance! If you need a car right away and don't have a down payment, we can help.

Considering no deposit car finance? Keep in mind that your monthly payments will likely be higher compared to putting a deposit down. Get no-deposit car finance with Marsh Finance.

Let's find the perfect car finance option for you!

Is PCP Right For Me?

PCP can be a good choice if you:

- Prefer lower monthly payments: PCP payments are typically lower than HP because you're only financing part of the car's value.

- Like to upgrade your car frequently: PCP car finance makes it easy to trade in your car for a newer model at the end of the agreement.

- Want flexibility at the end: With PCP, you have options like returning the car, owning it with a final payment (balloon payment), or using the equity as a down payment on a new car.

Here are some things to consider before choosing PCP car finance:

- Mileage restrictions: PCP car finance agreements often have mileage limits. Going over the limit can result in extra fees.

- Keeping the car in good condition: You'll typically need to return the car in good condition at the end of the agreement.

What is the eligibility criteria for PCP car finance?

To qualify for PCP, lenders consider several factors, but generally look for:

- Stable income: This shows you can afford the monthly payments.

- Good credit history: A strong credit score indicates responsible borrowing habits.

- Minimum age: You'll usually need to be over 22 years old. In some cases, exceptions might be made for those with a mortgage or a proven track record of loan repayment (e.g., previous HP agreement).

Here's why these factors matter:

- PCP is a long-term commitment: The lender wants to ensure you can reliably make payments throughout the agreement.

- Responsible borrowing is key: A good credit history suggests you manage debt responsibly.

Keep in mind: Eligibility criteria can vary slightly between lenders.

How old can a car be for PCP car finance?

There isn't a one-size-fits-all answer for this. The age limit for a PCP car can vary depending on:

- The lender: Different lenders have different policies. At Marsh Finance, we allow cars to be 7 years old at the end of the agreement.

- The car's condition and mileage: A well-maintained car with lower mileage will likely be eligible for a longer PCP term than a car that's older and driven more.

Here's the key thing to remember: PCP relies on the Guaranteed Minimum Future Value (GMFV) of the car at the end of the agreement. This means the car needs to hold its value well.

Generally, PCP is best suited for newer cars, typically up to 7 years old at the end of the agreement.

How can I make PCP more affordable?

Here are some tips to make PCP more affordable:

- Put down a bigger deposit: The larger your down payment, the lower your loan amount and, typically, your monthly payments will be.

- Choose a car with good resale value: PCP works best with cars that hold their value well (strong GMFV). This ensures the balloon payment at the end is manageable.

- Negotiate the car price: Like any purchase, you can negotiate the car's price to lower the overall cost of financing.

- Stick to mileage limits: PCP agreements often have mileage restrictions. Going over these limits can result in extra fees at the end.

- Consider the loan term: A longer loan term can make your monthly payments lower, but you'll end up paying more interest overall.

Finding the right balance is key! We can help you find a PCP deal that fits your budget and needs.

What does pre-approval mean in car finance?

Pre-approval is an important part of the car finance process. It shows that you could be someone eligible for finance, but more needs to be done to get your dream car. At the point of pre-approval, a soft credit check takes place. This doesn't affect your credit score, but going through with finance will mean a hard credit check. Pre-approval isn't a guarantee of a loan, but it's a really important start. If you are looking to get pre-approved for finance, we can help.

What is PCP car finance?

PCP car deals offer a flexible path to vehicle ownership. You'll start with a manageable deposit upfront, followed by fixed monthly payments spread comfortably over 2-4 years.

At the end of the term, you have three choices: return the car, pay a final balloon payment to own it, or trade it in.

PCP agreements have mileage limits and wear-and-tear guidelines. Interest rates will vary depending on your credit score.

Find Your Own PCP Car Deal 🚀

.png?width=600&height=500&name=Dream%20Car%20(11).png)