When it comes to the end of a Personal Contract Purchase (PCP) car finance agreement, many find themselves facing a balloon payment – a final lump sum to take full ownership of the car. If you’re in this situation and wondering, “Can I refinance my balloon payment?” the answer is yes, and Marsh Finance is here to guide you through the process. We aim to ensure you have all the necessary information and options for managing your balloon payment effectively.

Understanding Balloon Payments in PCP Agreements

Understanding Balloon Payments in PCP Agreements

A balloon payment, also known as the Guaranteed Minimum Future Value (GMFV), is predetermined at the start of a PCP agreement. This amount represents the car’s expected value at the end of the term and can vary significantly based on several factors, including the car’s make, model, and usage.

Refinancing Options for Balloon Payments

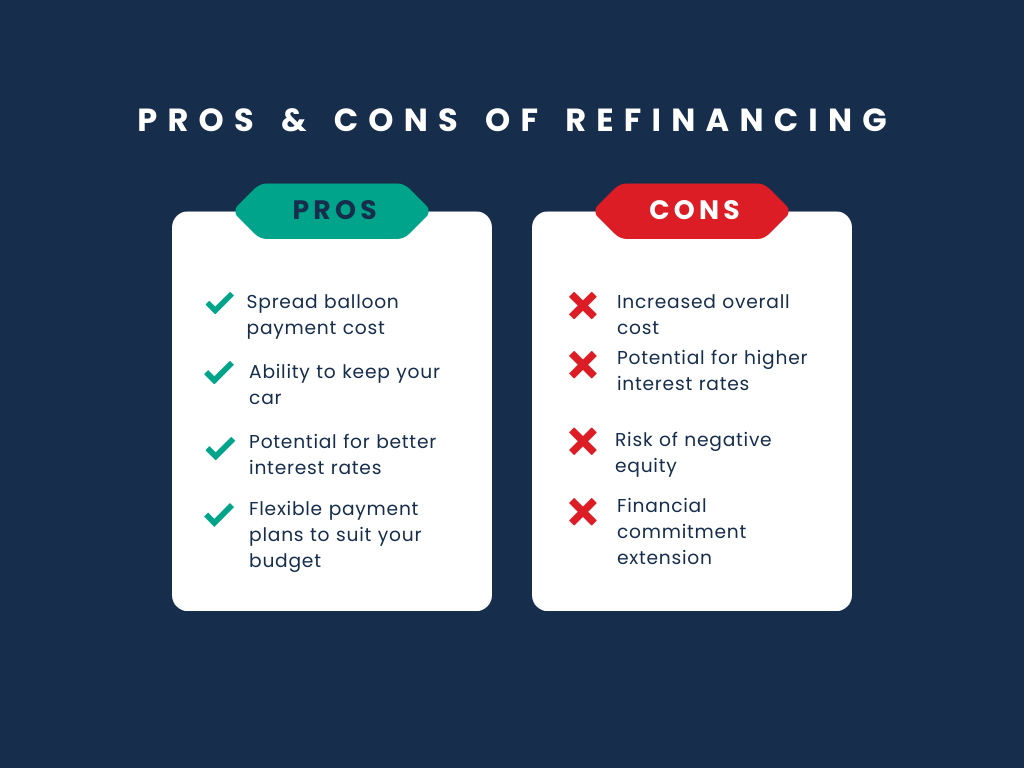

Refinancing the balloon payment is a practical solution for those who wish to retain their vehicle but can’t afford the lump sum payment outright. By refinancing, you can convert this large payment into manageable monthly instalments, much like your original PCP payments.

How Refinancing Works

Refinancing involves taking out a new loan to cover the balloon payment. This new agreement is separate from your original PCP contract and is treated as a standard car loan. The terms, including interest rates and duration, will depend on your credit score and financial circumstances.

Eligibility for Refinancing

Eligibility for refinancing a balloon payment depends on several criteria, including your credit score and financial history. At Marsh Finance, we offer a range of refinancing options and work with you to find the best solution based on your individual needs. Our car finance calculator can help you estimate potential monthly payments for the refinanced amount.

Applying for Refinancing

The application process for refinancing is straightforward. With Marsh Finance, you can apply within 30 seconds and find out if you’re pre-approved the same day. This quick and hassle-free process ensures you can make an informed decision without impacting your credit score. Click here to find out if you’re pre-approved today!

Alternatives to Refinancing

If refinancing isn’t the right choice, other options include returning the car at the end of the PCP agreement or using any positive equity as a deposit for a new deal. When deciding, it’s essential to consider your financial situation and future vehicle needs.

Wrapping Things Up

Refinancing your balloon payment at the end of a PCP agreement is a viable option for those who wish to keep their vehicle but need more flexible payment terms. At Marsh Finance, we are committed to helping you navigate this process easily. Explore our car finance options and use our tools, like the car finance calculator, to plan your refinancing effectively. Remember, understanding your financial options is key to making empowered decisions about your car finance needs. 🚗💡📈💳

Finance is subject to status

Representative Example

Rates from 12.9%

Representative example: borrowing £10,000 over 60 Months with a representative of 23.0% APR, an annual interest rate of 23.0% (fixed) and a deposit of £0.00, the amount payable would be 59 repayments of £269.58 per month, with one final repayment of £279.58 (which includes the option to purchase fee of £10.00), with a total cost of credit of £6,184.80 and a total amount payable of £16,184.80. Marsh Finance Limited are a lender, not a broker.

Marsh Finance Limited are a lender, not a broker.

This is for illustrative purposes only and is not a quote or an offer of finance.