The electric vehicle (EV) market has been the subject of fierce debate over the past year, with questions raised over various elements of EVs and how this will impact the industry moving forward. Of course, EVs provide a fantastic opportunity to reduce our carbon footprint and save substantial amounts of money on refuelling. In this case, it seems logical to suggest that EVs are the future. However, issues around price, charging infrastructure, identity, battery life and many others have called the industry’s direction into question. This is no more the case than for used car dealers and lenders, who must now make a tough decision over whether they commit to EVs in the near future.

EVs are depreciating rapidly, and their performance last year was a major factor in the downturn the used car market faced in the second half of 2023. Although the market grew from last year, the customer outlook on EVs is at risk of flipping in the wrong direction. Startline’s October 2023 customer survey found that only 12% of respondents would opt for an EV, compared to 40% for petrol (Startline).

In this article, we take a look at the challenges facing used car dealers, lenders and finance providers regarding EVs.

The Financial Mismatch Between Petrol and EVs

Can You Keep Up? Constant Technological Development in EVs

The Financial Mismatch Between Petrol and EVs

EVs are considerably more expensive than their petrol/diesel alternatives. The Euromonitor International 2023 Voice of the Consumer found that 58% of respondents found EV’s too expensive. A great example of this is the new Vauxhall Corsa Design model in petrol, which will set you back £22,000, compared to the electric version priced above £30,000 (Vauxhall). This isn’t exclusive to the Corsa, with the Hyundai Kona the same. A new petrol car will cost £21,000 to £25,000, but an electric version will cost upwards of £30,000, a sharp increase represented only by a different fuel source. The increased costs are mostly down to the battery, with EV batteries accounting for up to 40% of total cost. This sharp increase in cost is simply putting customers off purchasing an EV, especially at a time when the cost-of-living crisis is still in full effect. As a result, car dealers stocking EVs may struggle to offload them, even at a reduced price, so long as they are higher than their petrol/diesel alternative. No manufacturer is yet to crack mass-market production of EVs, and so the increased price is likely to remain until producing batteries becomes cheaper. This is a concern for used car dealers, who fear that used EVs are simply not profitable compared to petrol/diesel alternatives. With the diminishing battery health issue, an EV depreciates in quality significantly and raises questions about its worth in a long-term lease agreement.

Poor Charging Infrastructure

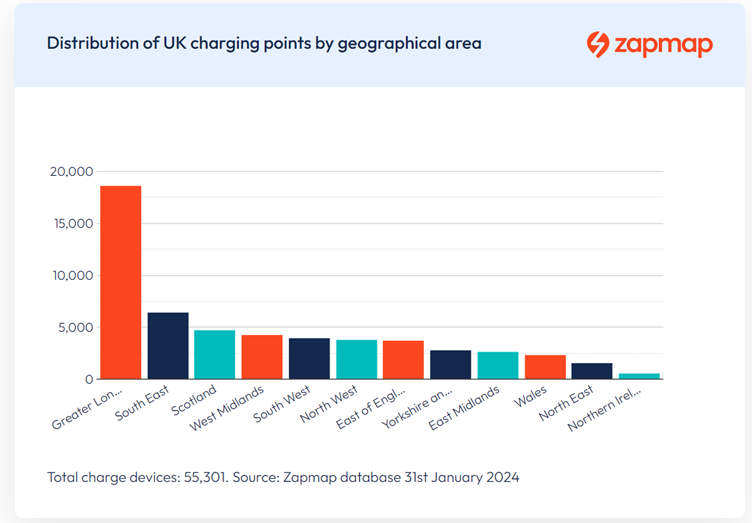

Although charging points are constantly springing up around the country, the distribution of these points is a contentious issue. As you can see below, the distribution of chargers is massively undistributed, with Greater London seeing the vast majority of chargers compared to anywhere else, housing over 30% of all chargers in the UK.

For people not in Greater London, finding a charger is much trickier and leads to many having to plan out log journeys with regular stops to charge on a set route. If there are road closures, this can massively impact your ability to charge and may even leave you stranded. This is a major concern for drivers, and when compared with the readily available petrol and diesel, it seems a no-brainer as to which car to choose for a long journey.

Poor Range & Battery Life

Another issue with batteries is their performance in different weather conditions. On a colder day, you may see the maximum range of your EV reduce slightly. This is because the chemical reaction needed to release the energy to power your car occurs much slower in colder temperatures. This results in lower maximum capacity in poorer conditions. On top of this massive issue, car batteries need to be replaced every three to four years, whereas a petrol engine can last over 10 years before it needs to be replaced. This makes it especially difficult for leasing, where a typical finance term is anywhere from three to four years, meaning that there’s a possibility the car could need a new battery during the term, and who pays for this? Is it the responsibility of the leasing agency, the manufacturer, or the customer? These questions are still yet to be answered, and so is a major reason why lenders and dealers are wary of committing to the EV market.

The Ethical Dilemma

Although EVs are great for the environment and seemingly do good over petrol and diesel, the ethics behind EV batteries is murky. Dubbed the ‘blood diamond of car batteries’ by the NY Times, cobalt mining for electric car batteries is unethical and dangerous for those involved. Children are expected to mine for the cobalt, putting them in extremely harsh conditions and exploiting them for financial gain. As a customer-facing organisation, lenders and dealers must be aware of the image their association with EVs portrays. This is, unfortunately, yet another nail in the coffin of current EVs.

Lack of Personality

The next point is something we have looked at in more detail in a separate piece, titled ‘Brand Loyalty and Identity: Challenges Facing the EV Market’. To summarise, the current influx of EVs has created a race to stand out, with manufacturers having to become more and more savvy with their car designs. EVs don’t have that iconic sound you might associate with a brand, and with near identical engines in most vehicles, customers are less likely to be loyal to a specific brand. For a used car dealer, assembling stock can be a massive challenge, as the demand for different EV models constantly sways from one to another. This presents a massive challenge, as there is no historical data to lean on, with the industry being so young, and so dealers must take a gamble that could blow up in their faces.

Can You Keep Up? Constant Technological Development in EVs

The final point follows from the concern around an over-saturated market. A major issue for used car finance lenders is how quickly EVs can become obsolete. Technology is constantly changing, and an EV from five years ago won’t compete with one released today. As a used car dealer, the value of your stock could be diminished as soon as tomorrow if a revolutionary new charging technology is released. The recent announcement by Toyota to have its cars run for nearly 500 miles based on one charge will no doubt influence customer behaviour in older EVs, and for used car dealers, this presents a massive issue.

How All These Issues Impact Lenders and Used Car Dealers

The EV market for lenders and used car dealers is plagued with worries, and it is no surprise that EVs are depreciating at an alarming rate. Issues with charging, durability, depreciation, loyalty and technological advancement have put many dealers off the used car market, opting for the stability of the long-established petrol and diesel industry. For the EV market to grow, the above issues desperately require solutions; otherwise, used car dealers and lenders will steer well clear of the likely financial hit associated with stocking EVs.

Maximise Your Earnings With Marsh

Marsh Finance are long-established used car finance provider, and know a thing or two about standing out in the densely-packed industry. Partner with Marsh today and gain access to a unique non-prime PCP product and stand out in the market.