New-Car Sales Dipped in August: Here’s How Smart Dealers & Brokers Will Make September Count

by Amy Roberts on Sep 5, 2025 3:20:52 PM

August is always a quirky month for UK registrations, but this year it came with a couple of big headlines: volumes edged down, and electric vehicles took a bigger slice of the pie. If you run a dealership or a brokerage, the question isn’t “good or bad?” … it’s “what do we do next?”

Here’s the picture in plain English, plus a practical playbook for the plate-change rush.

👉 What Actually Happened in August?👉 Why This Dip Isn’t a Drama, and What it Means

👉 Dealer & Broker Playbook for September (and Q4)

👉 Common Blockers We’re Seeing (and Quick Fixes)

👉 What Marsh Finance is Doing for Partners

👉 Useful Context for Your Board Pack

👉 Related Marsh Reads to Share With Your Team

👉 Bottom Line

👉 Partner with Marsh Finance

.webp?width=800&height=300&name=Person%20In%20Thought%20(1).webp)

What Actually Happened in August?

- Registrations fell 2.0% to 82,908 units: remember August is typically the quietest month and usually accounts for <5% of the year before September’s plate change. Source: https://www.smmt.co.uk/new-car-market-shrinks-in-august-but-evs-reach-record-share-for-the-year/

- Private demand ticked up 0.7%, while fleet softened -4.6% (still the lion’s share of the month at 59.1%).

- Battery-electric vehicles (BEV) hit their highest share of 2025 so far: 26.5% (up 14.9% YoY to 21,969 cars). PHEV surged too (+69.4%, 11.8% share). HEV slipped (-13.9%, 11.4% share).

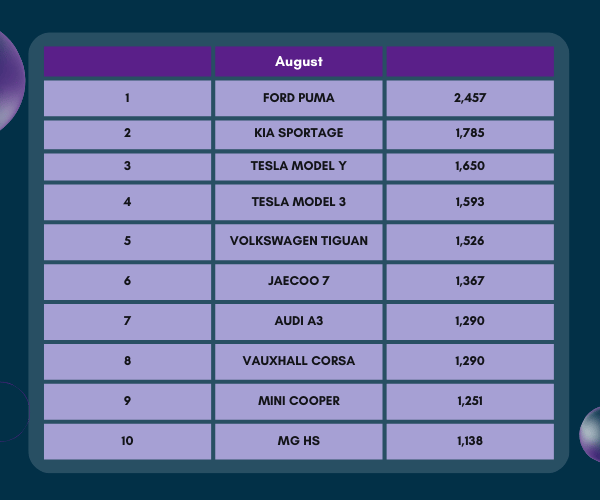

- Top models in August: Ford Puma, Kia Sportage, Tesla Model Y, Tesla Model 3, VW Tiguan, with newcomers like Jaecoo 7 popping into the top 10.

.webp?width=800&height=300&name=Downward%20Trend%20(1).webp)

Why This Dip Isn’t a Drama, and What it Means

August is historically quiet; the real test is the new plate in September. What matters for senior stakeholders is mix and momentum:

- Mix: More BEV/PHEV in the month means customers are engaging with greener stock and finance offers, even if overall volume eased.

- Momentum: Private registrations nudged up. That’s useful heading into plate-change campaigns where affordability messaging and same-day decisions win the last mile.

Dealer & Broker Playbook for September (and Q4)

1) Price integrity + payment flexibility

Stick to retail pricing; sell the affordability story. Lead with clear monthly examples and total amount payable on every listing and email. That’s how you convert traffic without feeding discount expectations.

2) Stock for speed

Blend fast movers (Puma, Sportage, Tiguan) with profitable niches. Align media budgets and remarketing lists to those models for two weeks post-plate.

August Top Models:

4) Private-buyer conversion

Private was +0.7% in August, a small move, but it tells you where to focus scripts and follow-ups: online part-ex valuations, weekend test-drive slots, and pre-approved finance links in your confirmations.

5) Fleet relationships without the lag

Fleet softened in August. If lead times or approvals are slowing deals, split your pipeline by lender and credit tier. Route clean files to the fastest decision engines; park complex cases with a specialist team so they don’t clog your SLA.

.webp?width=800&height=300&name=Looking%20(1).webp)

Common Blockers We’re Seeing (and Quick Fixes)

- “From £xxx” ads with no APR/term > Add representative APR, term, deposit and total payable everywhere you mention a monthly figure. (Also a Consumer Duty win.)

- PDF finance forms > Move to web forms with soft-search and auto-populate; you’ll lift completion rates immediately.

- Slow callback loops > Swap “we’ll call you” for a self-serve link to complete the application and upload docs.

What Marsh Finance is Doing for Partners

Marsh supports dealers and brokers with fast underwriting, soft-search tools, and flexible HP & PCP, including our non-prime PCP (we’re one of only two UK lenders with this product), so you can say “yes” to more customers without dropping your ticket price.

In a month where mix beats volume, the lender you lean on matters.

Useful Context for Your Board Pack

- August volume: 82,908 (-2.0% YoY); typically <5% of the year’s total.

- Fuel type share: BEV 26.5% (↑14.9% YoY), PHEV 11.8% (↑69.4%), HEV 11.4% (↓13.9%), petrol 45.1% (↓14.2%), diesel 5.2% (↓16.6%).

- Channel split: Private +0.7%, Fleet -4.6%, Business +41.6% (small base).

- Top 5 models (Aug): Puma, Sportage, Model Y, Model 3, Tiguan.

Related Marsh Reads to Share With Your Team

- Why Flat Retail Prices Spell Opportunity: Skip Discounting, Lean Into Finance Value (pricing + finance scripts)

- Used-Car Demand Is Up 3% YoY: Scale Your Finance Ops for Market Strength (ops capacity checklist)

- Is Your Website Consumer Duty Compliant? (digital journey quick wins)

Bottom Line

August dipped a touch, but the market sent you a clear signal: EV-curious buyers are active, private demand is steady, and September will decide the story. If your finance journey is fast and transparent, and your stock/ads mirror what’s hot, you’ll turn the plate-change spike into profitable, low-friction deals.

Partner with Marsh Finance

Need a lender who moves at your pace? We pride ourselves on speed, with automated decisioning and specialist non-prime PCP. We’ll help you maintain price integrity and lift approvals when it counts.

- February 2026 (2)

- January 2026 (10)

- December 2025 (9)

- November 2025 (3)

- October 2025 (12)

- September 2025 (8)

- August 2025 (13)

- July 2025 (25)

- June 2025 (17)

- May 2025 (10)

- April 2025 (5)

- March 2025 (6)

- February 2025 (4)

- January 2025 (4)

- December 2024 (10)

- November 2024 (14)

- October 2024 (12)

- September 2024 (25)

- August 2024 (74)

- February 2024 (1)

- May 2023 (2)

- March 2023 (1)

- February 2023 (1)

- December 2022 (1)

- October 2022 (2)

- August 2022 (1)